Payroll Management Services

This is unique web based service based on advance specific designed software which manages entire pay roll of your company. We meet the statutory requirements of various government Acts and Notifications issued time to time.

In said service manages the entire backend PAYROLL operations effectively and efficiently which heIps your organization to concentrate on your core business operations.

Payroll Compliance:

- Salary Sheet / WapeSheet 7 Salary Bank Sheet

- EPF Challans & Return y ESIC Challans & Return

- MLWB Challans & Return

- PTAX Challans & Return

- Payment of Bonus

- Employee Payslip

- Leave Management

- Allowances & Deductions Monthly Summary.

- Yearly & Monthly Salary Wages Summary and Details Report.

- Full and Final Settlement of Employee.

- Compliance of Salary Structure as per Minimum Wapes Act.

- Compliance as per Maternity Benefits Act.

- HR Policy including leave Policy.

- Maternity Benefits Act.

- Payment of Gratuity Act.

- Employee CTC.

EPF - Employee Provident Fund

As per “Employees' Provident Funds & Miscellaneous Provisions Act, Year 1952” and subsequent Notifications the Act applies to all factories and every other establishments, which employeestwentyor more workmen.

We offer the services for Registration of the companies to EPF Department, New Employee registration, Monthly compliance toward submission of Form 2, Form S. Form 9 and Monthly EPF Challans & Return. Make the payment to the concern department and complete required formalities in timely manner before the scheduled due dates. Undertake the activities of generation of UAN no for all the registered employees. Assist you in refund and settlement of claims in shortest time period.

ESIC - Employee State Insurance Corporation Act

The ESI a per Employees' State Insurance Act, 1948 (ESI Act)scheme is applicable to all factories and other establishments as defined in the Act with 10 or more persons employed in such establishment and the beneficiaries' monthly wage does not exceed Rs 21,000 are covered under the scheme.

We offer the services for Registration of the companies to ESI Department, New Employee registration, Monthly compliance like Monthly ESIC summary and challan Generation. Make the payment to the concern department and complete required formalities in timely manner before the scheduled due dates. Undertake the activities of generation of ESI no for all the registered employees. Assist you in refund and settlement of claims.

MLWB - Maharashtra Labor Welfare Board Act

The Act is applicable, to all factories and other establishments, Employing l0 or more workmen Firms in Maharashtra & need to undertake the registration with MLWB Department. We undertake the registration and statutory compliance on half yearly basis in timely manner.

Professional Tax

Various States across India Levy Professional Tax as per the prescribed State Rules. We undertake the registration with Professional Tax Department any meet the Monthly, Half Yearly and Yearly Requirements.

Payment of Gratuity

The Act is applicable, to all factories and other establishments, Employing l0 or more workmen. Gratuity is a lump sum amount that employers pay their employees as a sign of gratitude for the services provided. The gratuity rules are mandated under the Payment of Gratuity Act, 1972. We undertake the registration and statutory compliance on Monthly Basis in timely manner.

Payment of Bonus

As per Bonus Act, 1965 Applicable to all factories and every other establishments, which employs twenty or more workmen. We undertake the registration and statutory compliance in timely manner.

E-Tendering

We assist you to bid in the tender floated by various Government Institutions.

DS Consultancy services offers the said services at low cost, high quality and with innovative ideas.

It has team of young, experienced and dedicated team who believes in customer satisfaction and will advise you for your better growth and future. DS Consultancy Service has the team with aII professional Skills which Provide Large Volumes of Indian Procurement Tender Information On A Real Ti me Ba sis. DS Consultancy Service collects Government, Corporate Public Sector Procurement Tenders, B i d s Information, Business Lead s, Expression of Interest From The Various Daily Newspapers Trade Journals Online Website And Compiles The Business Leads Information In a Quickly Searchable Data base Format On Very Economical and affordable terms.

Registration and Certification

We assist to undertake registration and certification with various Government departments;

- PSARA (POLICE SECURITY LICENSES)

- Guard Board Exemption

- Labor License Registration

- EPF — Employees Provident Fund

- ESIC — Employees State Insurance Corporation

- PTAX - Professional Tax

- Private Limited / Partnership / LLP Registration

- Trademark Registration

- DSC (Digital Signature)

- Shop Act. / Food License

- GST — Goods & Service Tax

- MSME (Udyog Aadhar) / Pan card MLWB — Maharashtra Labor Welfare Board Import Export License

Our expertise in registration and certification helps you in completion of above mentioned registration in timely manner.

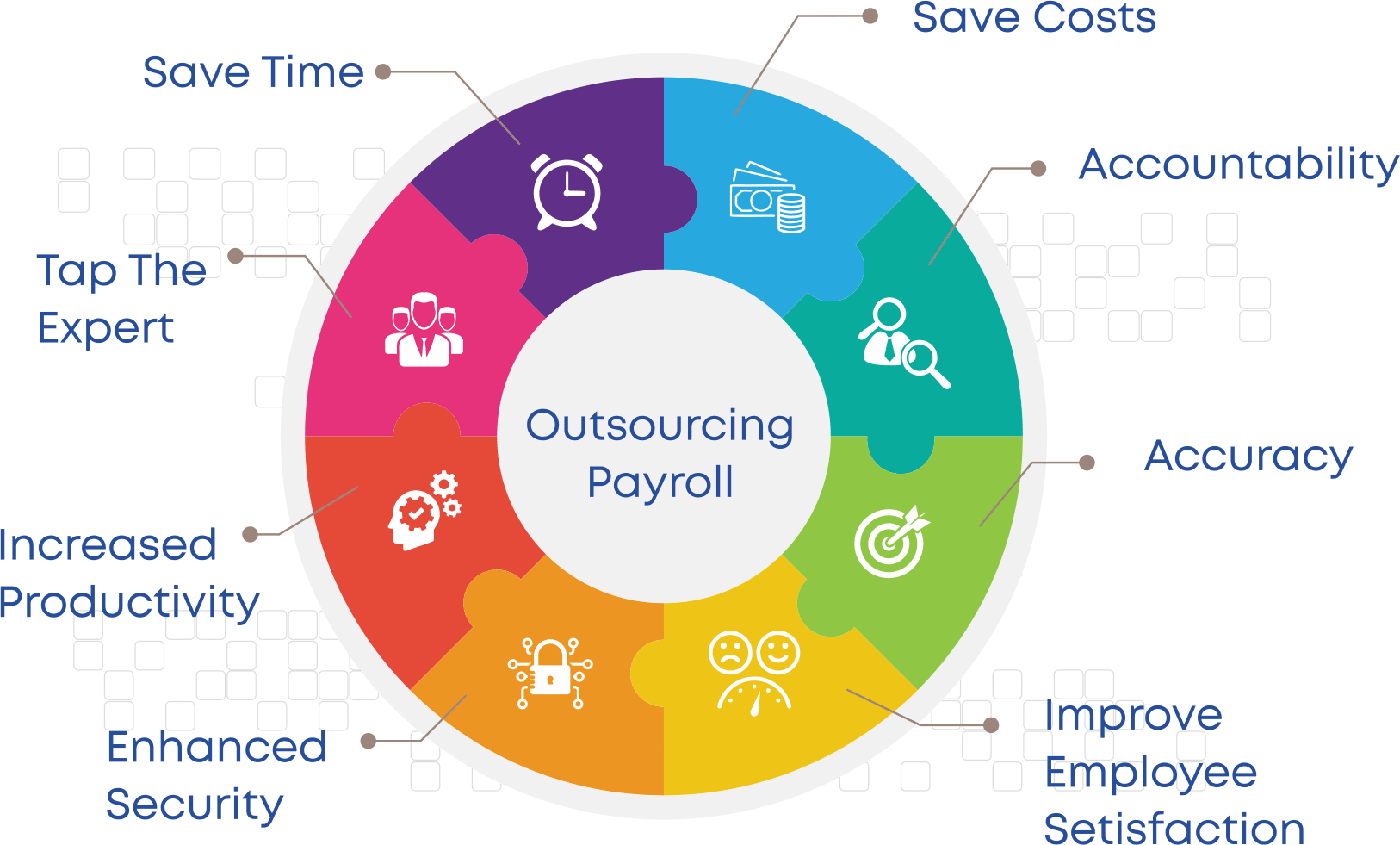

Outsourcing

Why Outsource and it's Benefits

Accurate and on time Employee payroll & complying with statutory laws are crucial to running a successful business. Quick & Easy access to accurate data points can help you pain insights into your workforce and help you make adjustments to alipn them to your business pools.

- Managed by Professional Experts which help you to concentrate on your core competencies and main business operations.

- Helps you to comply with statutory obligations with accuracy and in timely manner.

- By availing the said service will help you to achieve cost reduction to almost l/4 the of the Existing cost.

- Hassel free monthly compliance towards various Government Acts and Notifications.

- Need not worry on the attrition of the employees handling back-end HR team as the same will be taken care by our experts.

- Assist you for settlement of claims and refunds in timely and professional manner.